China is redefining the way to shop with Live shopping Part 1

June 14th, 2021

According to Financial Times, "Taobao Live has become one of the fastest-growing parts of Alibaba, generating over Rmb 400 billion in consumer spending during 2020, the Chinese e-commerce group has reported. Similar models have taken off in Japan, South Korea and south-east Asia, where a smartphone is many consumers’ first and only computing device."

Part 1) WHAT IS LIVE-STREAM SHOPPING?

Live-stream shopping is the next big thing in the world of e-commerce. It has been evolving into a billion-dollar industry in China. It provides entertainment while promoting products to a massive audience online. Live-stream shopping has hosts who directly interact with online customers through an online video platform. Similar to physical retailing service, brands can develop a close relationship with their customers via livestreaming. The real time interaction between live streamer and customers is interactive and engaging. Customers could immerse themselves in an exclusive shopping experience while being entertained.

Figure 1: Live streamers on Taobao Live

Figure 1: Live streamers on Taobao Live

Part 2) Why and how E-Commerce in China is Massive

With a large population, it is no surprise that China has a massive economy. E-Commerce has taken off well in China due to the growing interest in consumerism and digital entertainment. China’s eCommerce market stands at RMB $376 billion. The reasons for their booming e-commerce platform can be seen from the culture and spending habits in China.

In the West, online shopping is similar to retail shopping. Consumers search for the right deal based on brand trust and prior knowledge about brands. They would purchase different products on different platforms. In contrast, the Chinese favours huge online marketplaces like TMALL and JD.com, where they can get anything they want from one platform. Since Alibaba and JD.com are big Chinese companies, thus had already obtained trust from Chinese consumers. Consumers develop a relationship with vendors through online communication. They would then purchase as many goods in just one purchase. China has learnt to adopt the latest technology for easy usage on e-commerce platforms. Such as having direct payment systems in Alipay and WeChat Pay.

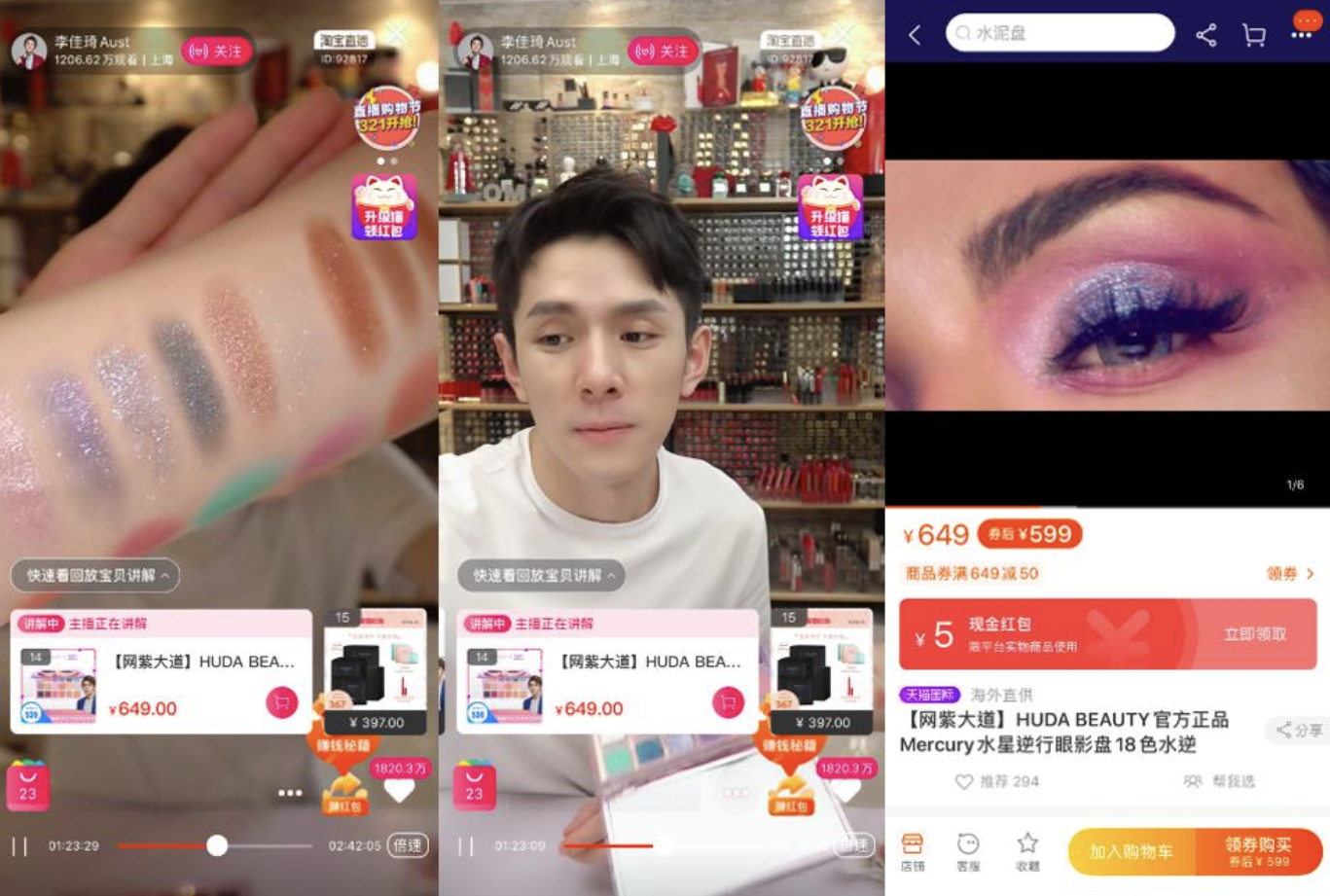

Figure 2: Taobao Live with direct page to purchase product after livestream immediately

Figure 2: Taobao Live with direct page to purchase product after livestream immediately

China’s quick tap into consumerism convenience, economic of scale, offering variety of products, and efficient and quick delivery has helped China’s e-commerce grow. In 2020, Chinese e-commerce has projected to reach 1 trillion dollars, raised from RMB $862 billion in 2019. Over 700 million Chinese people are shopping online verse 600 million in 2018. According to eMarketer, China has the highest rate of e-commerce of any country, with over 35% of total retail sales in 2019, 3 times more than the US market, and has one of the fastest growth rates than any country. China’s e-commerce powers cannot be underestimated.

Part 3) China’s Livestreaming E-Commerce Is Experiencing Explosive Growth

China’s Livestreaming E-Commerce is a collaborative platform between social media channels, Key Opinion Leaders (KOLs), brands etc. Live-streaming is a lot like Home Shopping Networks in the West, but with charismatic, trendy and entertaining live streamers to introduce new products. It is like a variety show with informational and entertaining content.

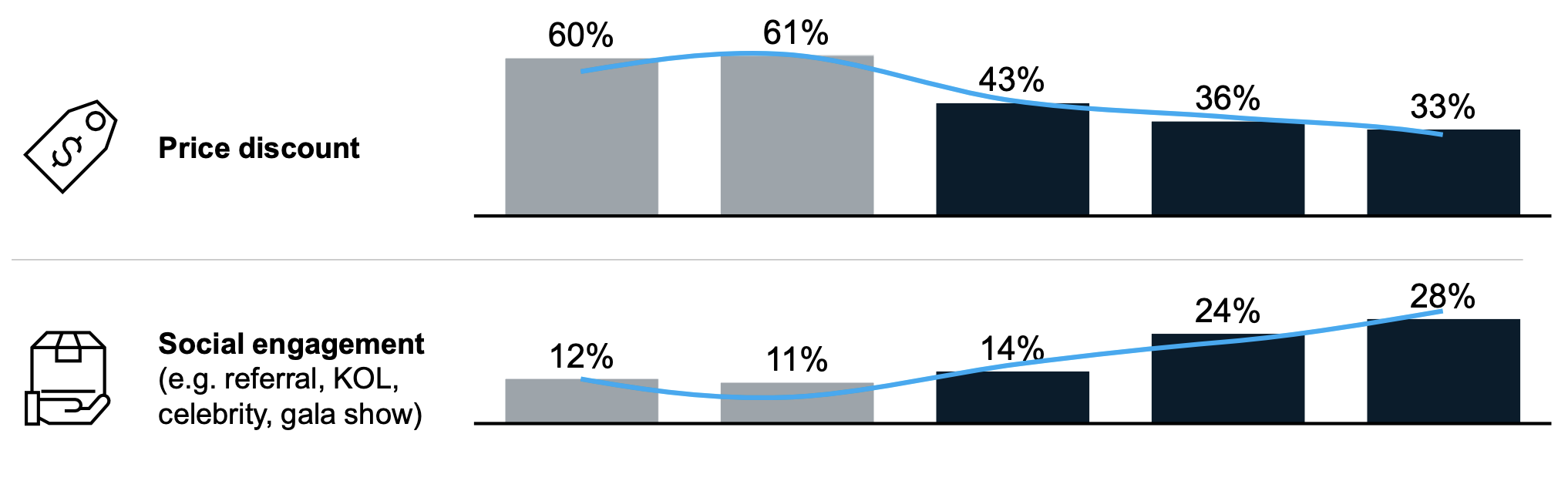

Figure 3: Top buying factors for e-commerce across different categories (Source: McKinsey China Digital Consumer Trends 2019)

Figure 3: Top buying factors for e-commerce across different categories (Source: McKinsey China Digital Consumer Trends 2019)

China has multiple e-commerce communication platforms. The most famous being Alibaba’s Taobao Live. 80% of live streaming happens there. However, other e-commerce platforms like Douyin and JD.com also jumped in to share the profit. Video entertainment platforms like Douyin, Kuaishou, Little Red book are also in partnership with e-commerce platforms to boost views in live streams. These Chinese social media ecommerce platforms have live streams functions within the apps that lead customers directly to brand pages for purchase. Livestreaming is a way for brands to interact and cultivate two way engaging relationship with customers. From small local businesses, craftsman, farmers to prestigious brands, They all showcase their products on this virtual shopping mall.

Especially with this year’s COVID lockdown restrictions, live streaming e-commerce grew even more rapidly. It is estimated to be at RMB $60 billion annually. In 2019, around 30% of the Chinese population in China viewed live streams. It grew to 39% by 2020. Sales grew to approximately 37% of the Chinese population in China in 2019. The sales are driven by Gen-Z and Millennials, but the middle-aged and seniors are also jumping on the trend. Alibaba experts are expecting a contribution of at least RMB $70 billion in gross merchandise value between 2019 and 2021 on all e-commerce platforms.

Part 4) Top Chinese Livestream Influencers have become Mega Celebrities helping brands and setting up their brands to sell

With the booming live streaming e-commerce platform, a rising group of content creators and influencers have been making a career off of live streaming. However, the industry is tough, with only a few that has led to a successful career. They are now, not only top Chinese Livestream influencers, but also mega-celebrities.

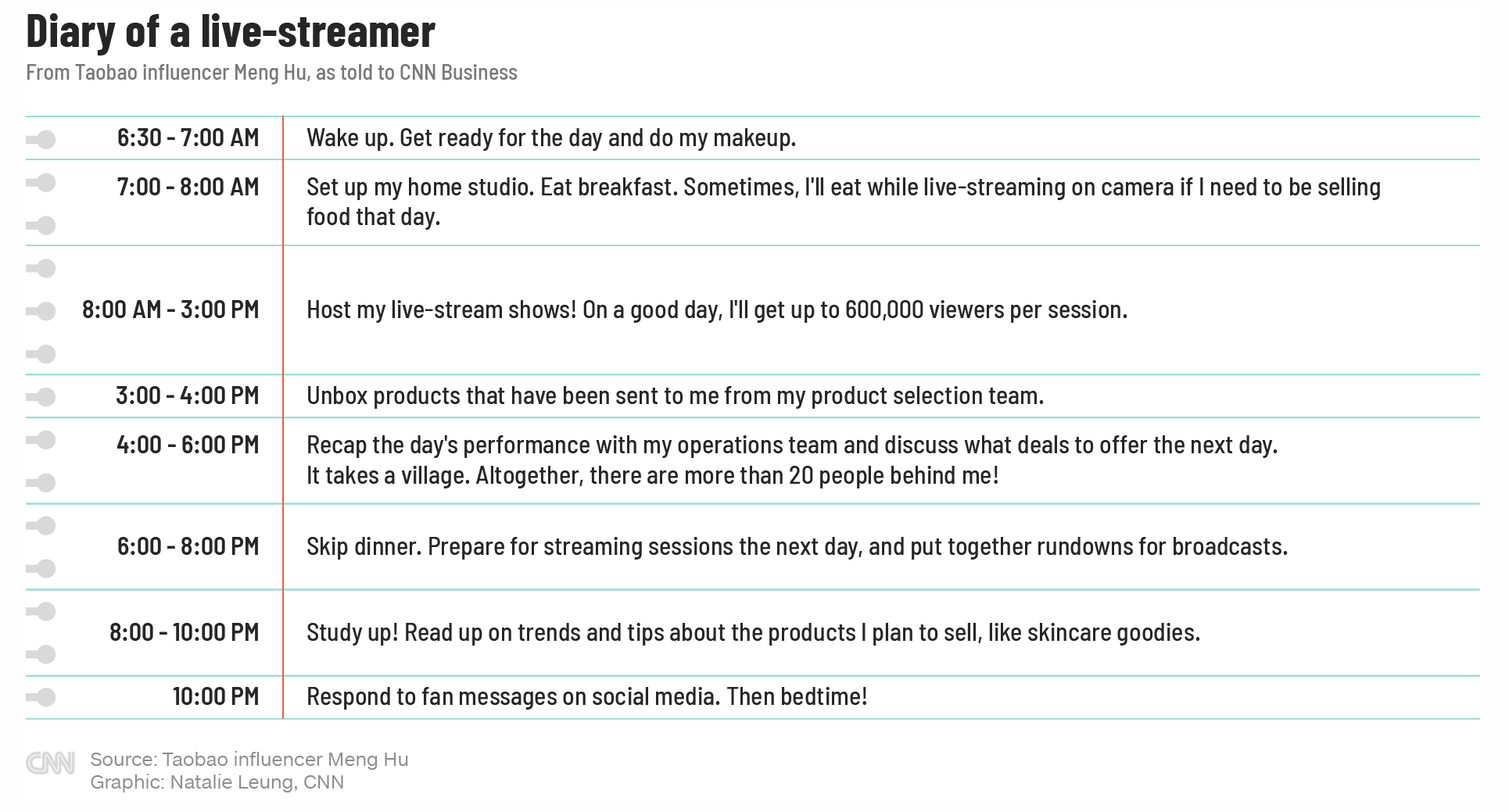

The life of a top influencer is not easy. They have live streams for approximately 4 hours every night, selling highly curated products with great discounts. It was estimated that they sell around 48 products per night, showcasing how the products are used, supported by descriptive elaboration of the products. The whole show must have the right amount of products of great quality, reasonable prices and attractive packaging. These quality controls are managed by the live streamers’ team. They need to prepare well before the show of what they would like to showcase every night. Hosts must demonstrate and critique the products, explain features, answer call-in questions, and at times collaborate and entertain with celebrity guests. There’s exciting sound effects when coupons and product links are revealed, and hosts would urge viewers with calls to action to purchase goods. They must maintain the viewers’ excitement to move them to purchase products.

Figure 4: A Diary of a live-streamer in China (Source from CNN)

Figure 4: A Diary of a live-streamer in China (Source from CNN)

Live streamers are known as KOL’s (key opinion leaders). Livestream e-commerce has made them huge, well-paid celebrities. They’re compensated differently than the West. Chinese live streamers will typically receive an appearance fee plus a large commission on each product sold. Currently, the most well-known Chinese live streamers on Taobao Live are Li Jaiqi (Austin Li) and Wei Ya (Viya Huang). They both gain massive popularity through live streaming on Taobao Live. Li Jaiqi (Austin Li) currently is an Chinese influential celebrity with around 44 million followers for his Livestream with an audience of 2 million viewers almost every night.

(Source: Photo 1)

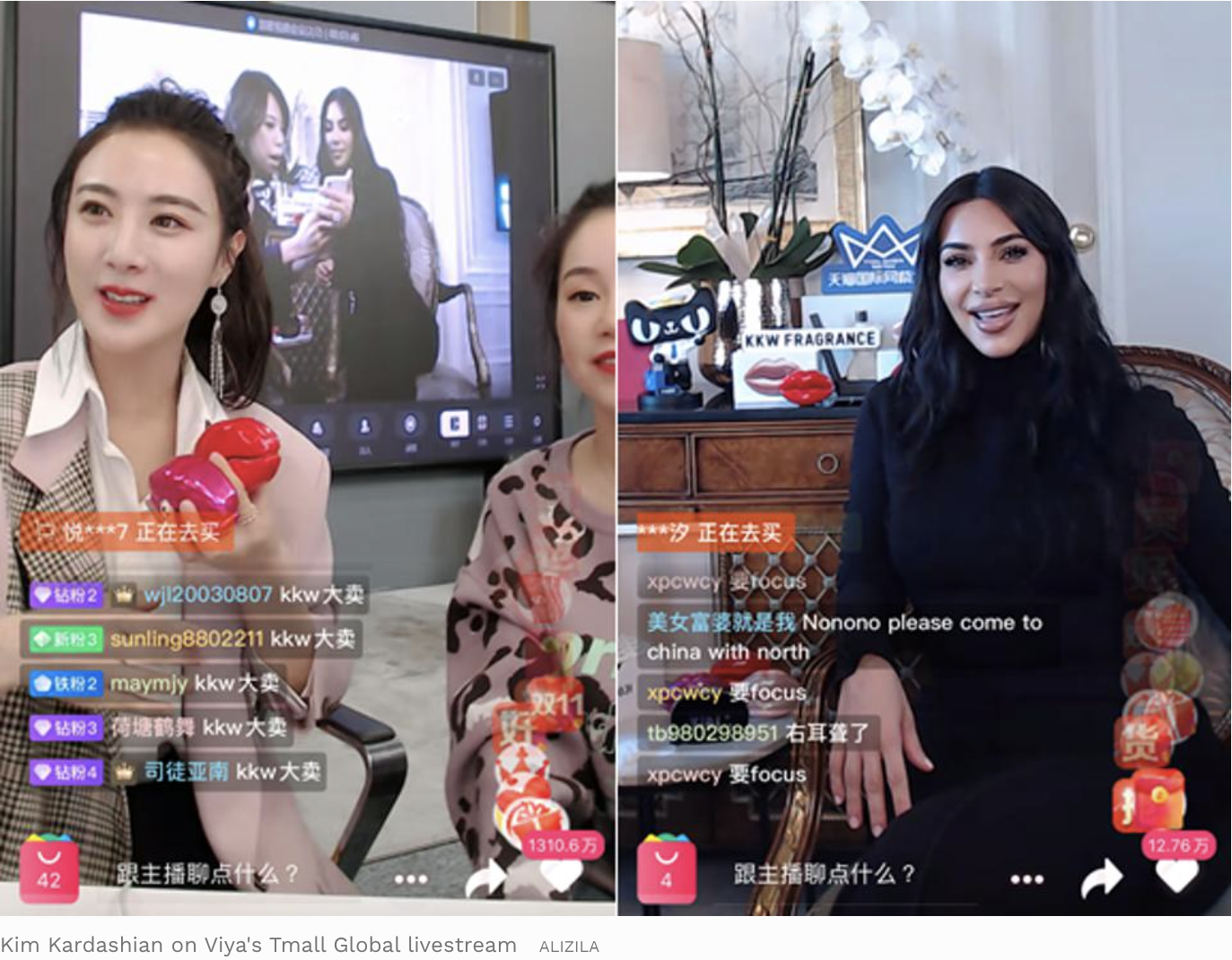

He has a high reputation for bringing great products to customers. He was famous for being the “Lipstick King”, demonstrating different lipstick brands on his lips. As he grew in fame, the more fans he has, the more bargaining power he has with brands to get the lowest price for his customers. Wei Ya (Viya Huang) on the other hand, built her fashion brand after gaining attention and support. In addition, she works with several foreign brands including Tesla. From cars to instant noodles, to cosmetics, she covers everything. Viya’s influential powers have even helped Kim Kardashian to drive 13 million viewers to her Livestream, which resulted all KKW perfumes selling out in just a few minutes. The monthly viewings for these two influencers are astonishing, with over 839 million for Viya Huang and 824 million for Austin Li in 2019. (Data source by: FORBES- Live Streaming E-Commerce Is The Rage In China. Is The U.S. Next? By Michelle Greenwald) Top influencers in China has a strong and impactful position in the current e-commerce platform in China.

Figure 5: Li Jiaqi (Austin Li)

Figure 6: Wei Ya (Viya Huang) on livestream with Kim Kardashian

Figure 6: Wei Ya (Viya Huang) on livestream with Kim Kardashian

Part 5) 2020 “Singles Day” sales

Figure 7: Singles Day (Double 11)

Figure 7: Singles Day (Double 11)

Singles Day, also known as “Double 11”, is an annual shopping holiday in China on November 11th. On this day, customers would expect huge discounts, new products, special packaging etc from brands. Much like Black Friday and Cyber Monday, this shopping festival holds great importance in the commercial field. However, this holiday has now grown to a one-month long shopping festival, starting October 21st. With the wider adoption of 4G/5G, consumers look for new and entertaining ways to learn about brands to purchase, making Singles Day a country-wide celebration.

This festival brings eye-popping numbers. In 2020, Singles Day sales on Alibaba through Taobao Live had already reached a staggering RMB $1.1 billion in the first 30 minutes on the first day of the Single Days month. That’s RMB $36.7 million in sales every minute. On the official November 11th Singles Day in 2020, Alibaba announced their impressive stats from Taobao Live. 17,000 brands live-streamed with more than 500 million viewers on the day. There was a total of RMB $2.8 billion in live shopping sales, with one live shopping channel having sold 55 cars in just 1 second.

The power of video e-commerce is unstoppable. Although Covid-19 has hindered the commercial market, it have boosted live shopping/ online shopping to new heights in 2020. Alibaba announced that there is a 7x increase of new merchants live streaming on Taobao live, 126 million more views on those live shopping streams, and the overall live shopping industry is forecasted to reach RMB $129 billion in 2020. With the remarkable results from 2020 Singles Day, live shopping accounts have a full 25% increase in Singles Day sales, compared to zero increase from a few years ago.

Part 6) How to live shopping applies to various sectors:

Beauty

Live videos were particularly successful for beauty brands, driving 16% of sales. Beauty live streaming usually directs into two different routes. A brand can contact popular influencers like Austin Li and Viya Huang to help promote the products. The other way is that brands can promote their products through the brand’s channel. For example, Estee Lauder live-streamed on their channel as well on popular influencer’s platforms at the same time. With the collaborative effort, Estee Lauder made RMB $28 million in sales, attracted 500 million views and became the top beauty sales on the T-mall platform.

Another way beauty brands could do is to collaborate with big prestigious labels to create special products for special events. For example, a popular cosmetic brand in China, Perfect Diary created an animal-themed eye makeup palette that they had co-branded with Discover Channel. They used the eye makeup palette to create colourful looks on their live-streams. The co-branded products were even packaged with rabbit, deer and fish designs. This has attracted a lot of sales.

Figure 8: Perfect Diary x Discovery Channel collaboration

Figure 8: Perfect Diary x Discovery Channel collaboration

Art, Luxury and Fashion

Luxury brands have been learning to master different Chinese social e-commerce platforms and learning different strategies to target different consumers. Live streaming had been considered to associate more with fast-moving consumer goods or beauty products. However, in recent years, it has also proved to be a useful marketing tool for luxury brands. Luxury brands in fashion or jewellery like Cartier, IWC, Chopard take live-streaming to showcase their most valued boutique pieces. It is like a fashion show. They often feature higher-level KOLs, brand CEOs, or even celebrities. The difference to beauty brand live streams is that they lean more to showcase their products than to attract sales. Some luxury brands also create digital showrooms, for clients to view products in virtual reality. Therefore, the impact of live-streaming should not be ignored by luxury brands. Cartier, for example, showed a necklace and broke through in having RMB 100 million in sales during the Singles Day shopping festival.

Figure 9: Live VR experience of luxury brands

Figure 9: Live VR experience of luxury brands

Part 7) Chinese consumers in smaller cities are the new powerhouse of growth

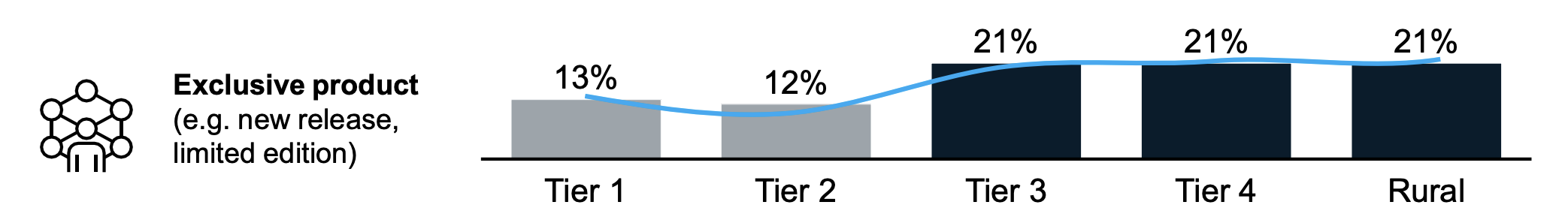

In the rapid growth in e-commerce, consumers have an important role in supporting the system. As China’s social e-commerce matures, consumerism in large affluent cities is starting to enter a stage of slower growth. Tier 3 and 4 cities are now starting to emerge as new sources of income for China’s e-commerce. Over the last two years, more than 70% of Taobao’s new users came from smaller cities. In 2020, JD.com had recorded 80% of their Singles Day orders from smaller cities. Lower-tier cities have been pushing sales on Chinese group-buying sites like Pinduoduo (拼多多). Lower tier city consumers have been using social e-commerce platforms a lot. On Singles Day, JD’s Jingxi group-buying app recorded an increase of 40% new users, in which smaller city users took up 70% of the record. This shows that brands should also notice the new purchasing powers of lower-tier cities.

Figure 10: Percentage amount of purchase in different city tiers in China (Source: McKinsey China Digital Consumer Trends 2019)

Figure 10: Percentage amount of purchase in different city tiers in China (Source: McKinsey China Digital Consumer Trends 2019)

Livestreaming E-commerce has become an important marketing strategy in a business. Brands must learn to connect with customers through live streaming. Livestreaming does not only bring in an authentic entertainment purchasing experience but also a trustworthy relationship with customers. There are strong predictions that online retail will continue to stay high even after COVID. The unstoppable influence in live stream shopping can be proven by the powerful Chinese e-commerce. With brands collaborating with KOLs, the gross revenue can be at a staggering level. Therefore, live streaming must not ignored. It is of great importance.

If you would like to learn more about how live shopping work and discover more successful for China market, follow us for part 2 on China’s live-streaming culture. We will bring you more information about the Livestream shopping and e-commerce in China.

If you are a brand and would like to learn more about live streaming to boost your brand awareness in China, contact us now.